Ano ang HospiKaya?

Bukod sa iyong PhilHealth Benefits,ang HospiKaya ay Health Plan Insurance na pinoprotekatahan ang local workers against financial loss dahil sa mahalna pagpapagamot.

Features

Pioneer HOSPIKAYA Health Card (Front)

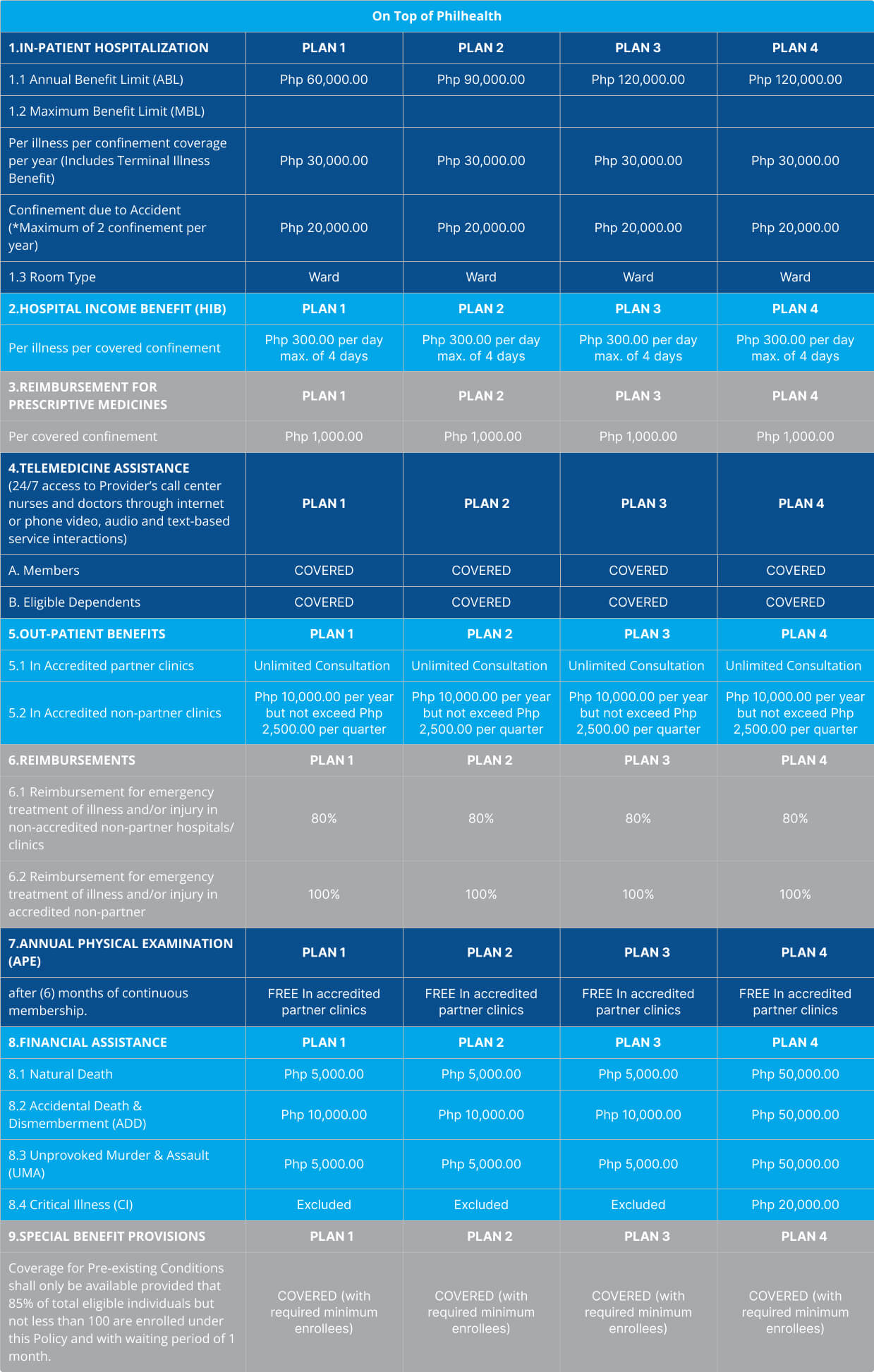

Schedule of Benefits

Eligible Dependents

Unlimited Consultations

- 24/7 Telephone Medical Assistance

If Single

- Parents Below 65 years old

If Married

- Legal Spouse and all children ages 5-21 years old

Financial Assistance

Add-On Benefits

(Available under Plan 4 ONLY)

Natural Death

- Php 50,000.00

Accidental Death & Dismemberment (ADD)

- Php 50,000.00

Unprovoked Murder & Assault (UMA)

- Php 50,000.00

Critical Illness (CI)

- Php 20,000.00

Accredited Hospitals and Clinics

Telemedicine Assistance

- Unlimited consultation

- Electronic Prescription

- Laboratory request referral

- Medical certificate, if applicable

- Post-consult follow-up

In-patient Care Benefit

- Accredited Physician’s services;

- Medicines administered during treatment, or for immediate relief;

- Oxygen and intravenous fluids;

- Dressings, plaster casts, and sutures;

- Laboratory tests, X-rays, and other diagnostic examinations directly related to the emergency management of the patient; and

- All other Hospital charges deemed necessary by an accredited Physician in the treatment of the patient.

Annual Physical Examination

- Physical Check-up/Consultation

- Chest X-Ray

- Fecalysis

- Urinalysis

- Complete Blood Count (CBC)

Pre-existing Conditions

- Hypertension;

- Thyroid disease, Goiter;

- Cataracts/Glaucoma/Pterigium;

- Ear nose and/or throat conditions requiring surgery;

- Asthma;

- Tuberculosis;

- Chronic cholecystitis/cholelithiasis and other forms of calcification;

- Hernia;

- Prostate disorders;

- Hemorrhoids and fistulae;

- Tumors;

- Uterine myoma, ovarian cyst, endometriosis;

- Buerger’s disease;

- Varicose veins;

Out-patient Care Benefit

- Medical consultation during regular Clinic hours, excluding prescribed medicines;

- Emergency room care;

- Eye, Ear, Nose, and Throat consultations;

- Treatment of minor injuries or illnesses (including ATS and Toxoid vaccines, if indicated);

- Laboratory tests, X-rays, and other diagnostic examinations prescribed by the accredited Physician;

- Minor surgery not requiring Confinement;

- Speech therapy (for stroke patients only) and physical therapy up to the Maximum Benefit Limit (MBL) per policy year; and

- Pre-natal and post-natal consultations up to the Maximum Benefit Limit (MBL)

Hospital Laboratory & Diagnostic Procedures

- Complete Blood Count (CBC)

- Fecalysis

- Blood Typing

- Platelet Count

- Fasting Blood Sugar (FBS)

- Blood Urea Nitrogen (BUN)

- Creatinine

- Blood Uric Acid (BUA)

- Cholesterol

- Triglycerides

- High Density Lipoprotein (HDL)

- Low Density Lipoprotein (LDL)

- Chest X-ray

- Electrocardiogram (ECG)

- Scoliosis;

- Arthritis;

- Chronic allergies;

- Gastric and duodenal ulcers;

- Any illness or injury for which any professional advice or treatment has been obtained, or which was evident upon medical examination, or of which the natural history can be clinically determined to have started prior to any availment whether or not the Insured Individual is aware of such illness or injury;

- 20. Dreaded Diseases.

Exclusions:

1. Any charges for services rendered by anyone other than an accredited Physician, except in cases of Emergency and Point-of-Service (Thru reimbursement limit)

2. Hospital charges for special or private nursing services, supplemental foods and medicines like vitamins and minerals (unless prescribed), extra accommodation and non-medical personal appliances such as radio, television, telephone, or computer;

3. Additional hospital charges resulting from obtaining a room accommodation higher than the Insured Individual’s allowable Room and Board Accommodation, subject to the formula set by the Insurer for computing incremental costs;

4. Health, annual, or pre-employment check-ups for other companies, or as part of government requirements, insurance purposes or travel abroad;

5. Recuperation such as confinement in a sanitarium or convalescent home, rehabilitation medicines (including work-ups), Custodial Care, Domiciliary Care, government-imposed quarantines;

6. Professional fees in medico-legal cases;

7. Refusal to undergo recommended treatment or demanding treatment for which Physicians accredited by the Insurer believe a professionally acceptable alternative exists;

8. Blood screening;

9. Vaccines for immunization, steroid injections, anti-rabies or anti-venom,

10. All expenses incurred in the process of organ donation and transplantation, unless the Insured Individual thereof is the recipient of such donation or transplantation, in which case the cost of organ and any expenses associated with the donor shall be excluded;

11. Procurement or use of eyeglasses, cost of lens, special braces, steel implants, buckles for retinal detachment, wheelchairs or prosthetic appliances including but not limited to items such as artificial limbs, hearing aids, crutches, intra-ocular lens, contact lenses, artificial hips or joints, pacemakers, mesh (for hernia), stents and ventilating tubes;

12. Determining/ruling out of Pre-Existing Condition (PEC) during the first 12 months of membership if result is positive;

13. Determining /ruling out of hepatitis or tuberculosis, if result is negative, unless the tuberculin test is prescribed by an accredited Physician for screening and diagnostic purposes;

14. Circumcision, infertility or fertility and virility/potency (erectile dysfunctions), artificial insemination, sex change;

15. Eye corrections such LASIK, PRK and the like;

16. Acupuncture, chiropractic treatment, iridology, chelation, cell implant therapy;

17. Speech or physical therapy in excess of twelve (12) sessions, except patients whose physical and speech therapy are covered up to Maximum Benefit Limit (MBL);

18. Sleep Study, unless directly related to an organic illness;

19. Reconstructive surgery, except to treat a functional defect directly caused by accident or illness covered in this Group Policy (provided that an accredited Physician recommends it and only for cases that affect the physiological functions of the Insured Individual), cautery of milia, xyringoma, facial moles, aesthetic, Cosmetic Surgery or cosmetic alterations for beautification purposes; cautery of warts in excess of PHP1,000 per Insured Individual per policy year, except genital warts and condyloma acuminatum, which are not covered under this Group Policy;

20. Out-patient medicines and medical supplies, except in cases of Emergency as defined in this Policy;

21. Congenital abnormalities such as neonatal hernia, indirect hernia, hemangioma, phimosis, harelip, clubfoot, cerebral palsy, renal diseases such as medullary sponge kidney, pediatric cardiovascular work-up and the like;

22. Developmental delay;

23. Neuro-developmental disorders such as Attention Deficit Hyperactive Disorder (ADHD), Autism, Genetic Disorder which may result to Mental Retardation (e.g. Down Syndrome), and other conditions which may require speech or physical and other related therapies;

24. Sexually transmitted diseases, AIDS and AIDS-related complex or conditions;

25. Substance addiction or reaction to use of prohibited drugs, alcoholism, alcohol intake, anxiety reaction, psychiatric and psychological illnesses, neurotic and psychiatric behavior disorders, or accidents arising from these conditions;

26. Guillaine-Barre Syndrome;

27. Pre-Existing Condition (PEC) during the first twelve (12) months of cover;

28. Hypersensitivity tests to check for allergies and desensitization, except that allergy testing and allergy screening shall be covered up the Maximum Benefit Limit (MBL) per policy year;

29. Any disability which may have affected a Dependent prior to the thirtieth (30th) day after birth;

30. Pregnancy, complications due to abnormal pregnancies such as, but not limited to, ectopic pregnancy, tube pregnancy, h-mole, abruptio placenta, placenta previa etc., childbirth, miscarriage, abortion;

31. All other treatments, laboratory examinations, diagnostic procedures and surgical procedures not specifically covered under in this Group Policy are considered not covered.

32. War-like or combat operations, government declared acts of rebellion, active participation in riots or demonstrations, strikes or labor disputes, terrorism, provoked criminal acts, violation of a law or ordinance, commission of a crime whether consummated or not, serving in military, naval, or air forces of any country or international authority, unnecessary exposure to imminent danger or hazard, active participation in setting off and/or handling pyrotechnic materials, attempted suicide, self inflicted injuries;

33. Government declared epidemics, complete or partial destruction of Hospital by fire, flood, or other perils, earthquake, tsunami, volcanic eruption; acts or order of government, brownouts; and

34. Aviation or aeronautics or sea travel other than as a fare-paying passenger on a licensed aircraft/vessel operated by a recognized airline/operator.